UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under Rule 14a-12 |

Altitude Acquisition Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee computed previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

In connection with the previously announced business combination between Altitude Acquisition Corp. and Picard Medical, Inc. (“Picard”), Picard used this investor presentation on September 20, 2023. A copy is being filed herewith as additional soliciting material.

SynCardia (“TAH”) Total Artificial Heart The gift of time Saving one life at a time

THIS PRESENTATION (TOGETHER WITH ORAL STATEMENTS MADE IN CONNECTION HEREWITH, (THIS “PRESENTATION”) IS BEING PROVIDED TO YOU SOLELY FOR YOUR INFORMATION. THIS PRESENTATION HAS NOT BEEN APPROVED BY ANY REGULATORY AUTHORITY. THIS PRESENTATION DOES NOT CONSTITUTE AN OFFER TO SELL OR ISSUE, OR ANY SOLICITATION OF ANY OFFER TO PURCHASE, SUBSCRIBE FOR OR OTHERWISE AQCQUIRE, ANY SECURITIES IN ANY STATES OR JURISDICTIONS IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL, AND NOTHING CONTAINED HEREIN SHALL FORM THE BASIS OF ANY CONTRACT OR COMMITMENT WHATSOEVER. THIS PRESENTATION MAY NOT BE PUBLISHED OR FURTHER DISTRIBUTED, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, TO ANY OTHER PERSON IN ANY JURISDICTION WHERE, OR TO ANY OTHER PERSON TO WHOM, TO DO SO WOULD BE UNLAWFUL. This Presentation is only being provided to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between Altitude Acquisition Corp. (“Altitude” or “ALTU”) and Picard Medical, Inc. (the “Company”). References to the Company include the Company and its subsidiaries, including SynCardia Systems, LLC (“SynCardia”). The information contained herein does not purport to be all-inclusive and none of Altitude, the Company, or any of their respective affiliates nor any of its or their control persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. The reader shall not rely upon any statement representation or warranty made by any other person, firm or corporation (including, without limitation, Altitude, the Company, or any of their respective affiliates or control persons, officers, directors and employees) in making its investment or decision to invest. None of Altitude, the Company, any of their respective affiliates nor any of its or their control persons, officers, directors, employees or representatives, shall be liable to the reader for any information set forth herein or any action taken or not taken by any reader, including any investment in shares of Altitude or the Company. Forward-Looking Statements This Presentation contains statements that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts and can generally be identified by the use of future dates or words such as “may,” “should,” “could,” “will,” “expects,” “seeks to,” “anticipates,” “plans,” “believes,” “estimates,” “intends,” “predicts,” “projects,” “forecast,” “potential” or “continue” or the negative of such terms and other comparable terminology. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements due to numerous factors, risks, and uncertainties that could cause actual results to differ materially from such estimates or forecasts. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information in this Presentation. Such forward-looking statements speak only as of the date on which they are made and Altitude and the Company do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this Presentation. Forward-looking statements in this presentation may include, for example, statements about: the Company’s growth strategy, future operations, financial position, estimated revenues and losses, projected capex, prospects and plans; the Company’s strategic advantages and the impact those advantages will have on future financial and operational results; the implementation, market acceptance and success of the Company’s products; the Company’s approach and goals with respect to research and development; the Company’s expectations regarding its ability to obtain and maintain intellectual property protection and not infringe on the rights of others; changes in applicable laws or regulations; and the outcome of any known and unknown litigation and regulatory proceedings. Neither Altitude, the Company nor any of its subsidiaries, affiliates, representatives or advisors assumes any responsibility for or makes any representation or warranty (express or implied) as to, the reasonableness, completeness, accuracy or reliability of the estimates and information contained herein, which speak only as of the date identified on the cover page of this Presentation. Altitude, the Company and their respective affiliates, representatives and advisors expressly disclaim any and all liability based, in whole or in part, on such information, errors therein or omissions therefrom. Neither Altitude, the Company nor any of their respective affiliates, representatives or advisors intends to update or otherwise revise the estimates and other information contained herein to reflect circumstances existing after the date identified on the cover page of this Presentation to reflect the occurrence of future events even if any or all of the assumptions, judgments and estimates on which the information contained herein is based are shown to be in error, except as required by law. Disclaimer (1/3)

Industry and Market Data In this Presentation, we rely on and refer to information and statistics regarding market participants in the sectors in which the Company competes and other industry data. We obtained this information and statistics from third-party sources, including reports by market research firms and publicly-available filings. While we believe such third-party information is reliable, there can be no assurance as to the accuracy or completement of the indicated information. We have not independently verified the accuracy or completeness of the information provided by the third-party sources. Trademarks This Presentation contains trademarks, service marks, trade names and copyrights of the Company and other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM, © or ® symbols, but the Company will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Further, third-party logos included in this Presentation may represent past or present vendors or suppliers of materials and/or products to the Company for use in connection with its business or may be provided simply for illustrative purposes only. Inclusion of such logos does not necessarily imply affiliation with or endorsement by such firms or businesses. There is no guarantee that the Company will work, or continue to work, with any of the third parties whose logos are included herein in the future. Additional Information and Where to Find It In connection with the Business Combination, Altitude intends to file a preliminary proxy statement and a definitive proxy statement with the Securities and Exchange Commission (“SEC”). Altitude urges its investors, shareholders and other interested persons to read, when available, the preliminary proxy statement, any amendments thereto, the definitive proxy statement, as well as other documents filed with the SEC because these documents will contain important information about Altitude, Picard and the Business Combination. When available, the definitive proxy statement will be mailed to shareholders of Altitude as of a record date to be established for voting on the proposed Business Combination. Once available, shareholders will also be able to obtain a copy of the definitive proxy statement and other documents filed with the SEC without charge, by directing a request to: Altitude Acquisition Corp., 400 Perimeter Center Terrace, Suite 151, Atlanta Georgia 30346. The preliminary and definitive proxy statement, once available, can also be obtained, without charge, at the SEC’s website (www.sec.gov). Participants in the Solicitation Altitude and Picard and their respective directors and executive officers may be considered participants in the solicitation of proxies with respect to the proposed Business Combination under the rules of the SEC. Information about the directors and executive officers of Altitude is set forth in Altitude’s annual report on Form10-K for the year ended December 31, 2022 filed with the SEC on March 23, 2023, and is available free of charge at the SEC’s website at www.sec.gov or by directing a request to: Altitude Acquisition Corp., 400 Perimeter Center Terrace, Suite 151, Atlanta Georgia 30346. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Altitude stockholders in connection with the proposed Business Combination will be set forth in the proxy statement for the proposed Business Combination when it is filed with the SEC. These documents can be obtained free of charge from the sources indicated above. Disclaimer (2/3) 3

Financial Projections This Presentation contains certain financial projections. These financial projections are for illustrative purposes only and relate to future performance and reflect the Company’s views as of the date of this Presentation. The financial projections are subject to known and unknown risks, uncertainties and assumptions that may cause future results, performance or achievements to differ materially from those expected. The Company believes the expectations reflected in these financial projections are reasonable but no assurance can be given that these expectations will prove to be correct and these financial projections should not be unduly relied upon. Neither the Company nor Altitude can guarantee future results, level of activity, performance or achievements. Consequently, the Company and Altitude no representation that the actual results achieved will be the same in whole or in part as those set out in the financial projections. The financial projections were prepared by the Company to assist with planning and operational decision making. The financial projections have been included in this Presentation as a tool to make an informed decision regarding the subject matter of this presentation and Recipients are cautioned that the financial projections may not be appropriate for other purposes. The Company has approved of these financial projections as of the date of this Presentation. The financial projections contained in this Presentation are expressly qualified by this cautionary statement. Recipients are cautioned not to place undue reliance upon any such financial projections, which speak only as of the date made. Except as required by applicable law, the Company and Altitude do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any financial projections to reflect any change in the Company’s or Altitude’s expectations or any change in events, conditions, assumptions or circumstances on which any such financial projections are based. Disclaimer (3/3) 3

The risks presented below are certain of the general risks related to the Company, SynCardia, Altitude, and the proposed business combination among the Company, Altitude and their respective subsidiaries, as applicable (the “Business Combination”), and such list is not exhaustive. You should carefully consider these risks and uncertainties, carry out your own diligence, and consult with your own financial and legal advisors concerning the risks and suitability of an investment in this offering before making an investment decision. Risks relating to the business of the Company will be disclosed in future documents filed or furnished by SynCardia and Altitude with the U.S. Securities and Exchange Commission (“SEC”), including the documents filed or furnished in connection with the Business Combination. The risks presented in such filings will be consistent with those that would be required for a public company in its SEC filings, including with respect to the business and securities of the Company and Altitude and the Business Combination, and may differ significantly from, and be more extensive than, those presented below. Risks Related to Our Business We have a history of significant losses. If we do not achieve and sustain profitability, our financial condition could suffer. All of our revenue is generated from a limited number of products, and any decline in the sales of these products or failure to gain market acceptance of these products will negatively impact our business. The manufacturing process of the SynCardia Total Artificial Heart (TAH) is complex and requires sophisticated equipment, experienced manufacturing personnel and highly specialized knowledge. If we are unable to manufacture the TAH on a timely basis consistent with its quality standards, our results of operations will be adversely impacted. We rely on specialized suppliers for key components of the SynCardia TAH and related drivers and do not have second-source suppliers for the majority of the SynCardia TAH’s components. The future worldwide demand for our current products and future products is unproven. Our current products and future products may not be accepted by hospitals, surgeons or patients, and may not become commercially successful. If we are unable to educate physicians on the safe and effective use of the SynCardia TAH, we may be unable to achieve our expected growth. If we fail to develop and retain a direct sales force and effective network of international distributors, we may be unable to achieve expected growth targets and our business could suffer. Reliance on distributors and third-parties to market and sell our products could negatively impact our business, because we may not be able to find suitable distributors for our products on satisfactory terms, agreements with distributors may prematurely terminate, our existing distributor relationships or contract may preclude us or limit us from entering into arrangements with other distributors, and we may not be able to negotiate new or renew existing distributing agreements on acceptable terms, or at all. We operate in a highly competitive market segment, which is subject to rapid technological change. If our competitors are able to develop and market technologies or products that are safer, more effective, less costly, easier to use or otherwise more attractive than our products, our business will be adversely impacted. We have significant customer concentrations, and economic difficulties or changes in the purchasing policies or patterns of our key customers could have a significant impact on our business and operating results. We have no long-term exclusive agreements with our customers and, as a result, generally operate on an invoice and purchase order basis to meet our customers’ needs. Our future success depends on our ability to develop, receive regulatory approval for, and introduce new products or product enhancements that will be accepted by the market. If we are unable to successfully complete the pre-clinical studies or clinical trials necessary to support premarket approval applications or PMA supplements, its ability to obtain approvals for new products will be limited. If third-party payors do not provide adequate coverage and reimbursement for the use of our products, it is unlikely that our products will be widely used and our revenues will be negatively impacted. Our manufacturing operations, research and development activities, and corporate headquarters, are currently based at a single location, which may subject us to a variety of risks. Product liability claims could damage our reputation or adversely affect our business. Product deficiencies could result in field actions, recalls, substantial costs and write-downs; these could also lead to the delay or termination of ongoing trials and harm our reputation and our business and financial results. Any claims relating to improper handling, storage or disposal of hazardous chemicals and biomaterials could be time-consuming and costly to address. Our international operations subject us to certain operating risks, which could adversely impact our results of operations and financial condition. Risk Factors 4

Risks Related to Our Business (Continued) We are subject to credit risk from our accounts receivable related to its product sales, which include sales within foreign countries that have recently experienced economic turmoil. We are subject to risks associated with currency fluctuations, and changes in foreign currency exchange rates could impact its results of operations. Our ability to use net operating losses to offset future taxable income may be subject to certain limitations; in addition, we may be unable to use a substantial part of our net operating losses if we do not attain profitability in an amount necessary to offset such losses. The industry- and market-related estimates included in this Presentation are based on various assumptions and may prove to be inaccurate. Our ability to maintain our competitive position depends on our ability to attract and retain highly qualified personnel. If we acquire other companies or businesses, form joint ventures or partner with companies in other jurisdictions, we will be subject to risks that could hurt our business. Failure to protect our information technology infrastructure against cyber-based attacks, network security breaches, service interruptions, or data corruption could significantly disrupt our operations and adversely affect our business and operating results. There can be no assurance that Altitude or the Company will be able to raise sufficient capital to consummate the Business Combination. Even if we consummate the Business Combination, we will need substantial additional funding to pursue our business objectives and continue our operations. If we are unable to raise capital when needed or on attractive terms, we may be required to delay, limit, reduce, or terminate our research or product development programs or future commercialization efforts. Risks Related to Regulation of Our Industry Our business is subject to extensive governmental regulation that could make it more expensive and time consuming to introduce new or improved products. The off-label use or misuse of our products may harm our image in the marketplace, result in injuries that lead to product liability suits, which could be costly to our business, or result in costly investigations and regulatory agency sanctions if we are deemed to have engaged in such promotion. We are required to comply with medical device reporting, or MDR, requirements and must report certain malfunctions, deaths, and serious injuries associated with our products, which can result in voluntary corrective actions or agency enforcement actions. Our employees, independent contractors, principal investigators, consultants, commercial partners and suppliers may engage in misconduct or other improper activities, including non-compliance with regulatory standards and requirements. We are subject to various federal, state and foreign healthcare laws and regulations, and a finding of failure to comply with such laws and regulations could have a material adverse effect on our business. The TAH is currently approved in the U.S. for temporary bridge to transplant indication. We plan to seek approval for long-term indication. If we do not receive that approval, we may need to undertake additional clinical trials, which could cost significant funds and adversely affect our business. In Europe, following a suspension, we voluntarily withdrew our CE certificate under the European Union Medical Device Directive (the “CE MDD”) in 2022 and terminated our relationship with our CE notifying body, and failure to reinstate our CE certificate under CE MDR or to establish a relationship with a new notifying body could have a material adverse effect on our business. Prior weaknesses in our CE MDD regulatory regime and compliance with developing European Union medical device regulations, including the CE MDD, may limit our ability to market or sell products in European markets or to introduce new products into European markets. Failure to obtain marketing approval in foreign jurisdictions would prevent our product candidates from being marketed abroad and may limit our ability to generate revenue from product sales. Our relationships with customers, health care providers, physicians, and third-party payors are subject, directly or indirectly, to federal and state healthcare anti-kickback and fraud and abuse laws, false claims laws, health information privacy and security laws, and other healthcare laws and regulations, which could expose us to criminal sanctions, civil penalties, exclusion from government healthcare programs, contractual damages, reputational harm, and diminished future profits and earnings. If we are unable to comply or have not fully complied with these laws, we could face substantial penalties. We may face potential liability under applicable privacy laws if we obtain identifiable patient health information from clinical trials sponsored by us. We are subject to anti-corruption laws, as well as export control, anti-money laundering, customs, sanctions, and other trade laws and regulations governing our operations. Compliance with these legal standards could impair our ability to compete in domestic and international markets. If we fail to comply with these laws, we could be subject to civil or criminal penalties, other remedial measures, and the payment of legal expenses, which could adversely affect our business, results of operations, and financial condition. Risk Factors 5

Risks Related to Intellectual Property Many aspects of the SynCardia TAH are no longer protected by patents, and we may be unable to protect our products from competition through other means. The medical device industry is characterized by extensive patent litigation, and we could become subject to litigation that could be costly, result in the diversion of management’s attention, require us to pay significant damages or royalty payments or prevent SynCardia from marketing and selling its existing or future products. If we fail to comply with our obligations in agreements under which we license rights to technology from third parties, or if the license agreements are terminated for other reasons, we could lose license rights that are important to our business. We may be subject to claims that we or our employees have inadvertently or intentionally used or disclosed trade secrets or other proprietary information of former employers of our employees. We may initiate, become a defendant in, or otherwise become party to lawsuits to protect or enforce our intellectual property rights, which could be expensive, time-consuming, and unsuccessful. Risks Related to Altitude and the Business Combination Altitude and the Company may not be able to obtain the required shareholder approvals to consummate the Business Combination. The consummation of the Business Combination is subject to risks that regulatory approvals are not obtained, are delayed, or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Business Combination. Altitude’s sponsor, officers and directors have potential conflicts of interest in recommending that its stockholders vote in favor of approval of the Business Combination. Altitude’s sponsor holds approximately 82% of the Company’s outstanding common stock and accordingly will be able to approve the Business Combination even if no other shares are voted in favor of it. Altitude’s sponsor has agreed to vote in favor of the Business Combination, regardless of how public stockholders vote. Altitude’s sponsor, directors, officers, advisors, and their affiliates may enter into certain transactions, including purchasing shares or warrants from public stockholders, which may influence a vote on the Business Combination and reduce the public “float” of its securities. Each of Altitude and the Company has incurred and will incur substantial costs in connection with the Business Combination, and related transactions, such as legal, accounting, consulting, and financial advisory fees, which will be paid out of the proceeds of the Business Combination. The ability of Altitude’s public stockholders to exercise redemption rights with respect to a large number of shares could deplete Altitude’s trust account prior to the Business Combination and thereby diminish the amount of working capital of the combined company. Subsequent to the consummation of the Business Combination, the combined company may be required to take write-downs or write-offs and restructuring, impairment, or other charges that could have a significant negative effect on its financial condition, results of operations, and share price, which could cause you to lose some or all of your investment. Uncertainty about the effect of the Business Combination may affect the Company’s ability to retain key employees and integrate management structures and may materially impact the management, strategy, and results of its operation as a combined company. Altitude is an emerging growth company subject to reduced disclosure requirements, and there is a risk that availing itself of such reduced disclosure requirements will make its common stock less attractive to investors. The consummation of the Business Combination is subject to a number of conditions, and, if those conditions are not satisfied or waived, the Business Combination agreement may be terminated in accordance with its terms and the Business Combination may not be completed. Legal proceedings in connection with the Business Combination, the outcomes of which are uncertain, could delay or prevent the completion of the Business Combination. Changes to the proposed structure of the Business Combination may be required as a result of applicable laws or regulations. Altitude and the Company will be subject to business uncertainties and contractual restrictions while the Business Combination is pending, and such uncertainty could have a material adverse effect on Altitude’s and the Company’s business, financial condition, and results of operations. If Altitude is deemed to be an investment company under the Investment Company Act, it may be required to institute burdensome compliance requirements and its activities may be restricted, which may make it difficult to complete the Business Combination. If Altitude is unable to complete the Business Combination or another initial business combination by December 11, 2023, Altitude will cease all operations except for the purpose of winding up, redeeming 100% of the outstanding public shares, and, subject to the approval of its remaining shareholders and Altitude’s board of directors, dissolving and liquidating. In such event, third parties may bring claims against Altitude and, as a result, the proceeds held in the trust account could be reduced and the per-share liquidation price received by shareholders could be less than $10.00 per share. The combined company may not be able to realize the anticipated benefits of the Business Combination. Risk Factors 6

Risks Related the Combined Company’s Securities Following Consummation of the Business Combination The requirements of being a public company may strain our resources, divert management’s attention, and affect our ability to attract and retain executive management and qualified board members. If, following the Business Combination, securities or industry analysts do not publish or cease publishing research or reports about the combined company, its business, or its market, or if they change their recommendations regarding the combined company’s securities adversely, the price and trading volume of the combined company’s securities could decline. An active trading market for the combined company’s shares of common stock may not be available on a consistent basis to provide stockholders with adequate liquidity. The stock price may be volatile, and stockholders could lose all or a significant part of their investment. Following the completion of the Business Combination, SynCardia or its principal stockholders may control a significant percentage of the voting power and will be able to exert significant control over the direction of the business. Such concentration of ownership may affect the market demand for the combined company’s shares. There can be no assurance that the common stock and warrants issued in connection with the Business Combination will be approved for listing on Nasdaq following the closing, or that the combined company will be able to comply with the continued listing standards of Nasdaq. Because the Company has no current plans to pay cash dividends for the foreseeable future, you may not receive any return on investment unless you sell your shares for a price greater than that which you paid for them. Future sales and issuances of the combined company’s common stock or rights to purchase the combined company’s common stock, including pursuant to the combined company’s equity incentive plans, or other equity securities or securities convertible into the combined company’s common stock, including Altitude’s outstanding warrants, could result in additional dilution of the percentage ownership of the combined company’s stockholders and could cause the stock price of the combined company’s common stock to decline even if its business is doing well. Warrants will become exercisable for the combined company’s common stock beginning 30 days after the closing of the Business Combination, which would increase the number of shares eligible for future resale in the public market and result in dilution to the combined company’s stockholders and could also cause the market price of our common stock to drop significantly, even if our business is doing well. Stockholders will experience immediate dilution as a consequence of the issuance of common stock as consideration in the Business Combination. Having a minority share position may reduce the influence that stockholders have on the management of the Company. If we fail to establish and maintain effective internal controls, our ability to produce accurate and timely financial statements could be impaired, which could harm our operating results, investors’ views of us, and, as a result, the value of our common stock. Our internal controls and procedures may not prevent or detect all errors or acts of fraud. Changes to, or application of different, financial accounting standards (including PCAOB standards) may result in changes to our results of operations, which changes could be material. Following the Business Combination, anti-takeover provisions contained in the combined company’s certificate of incorporation and bylaws, as well as provisions of Delaware law, could delay or prevent a change in control, which could reduce the market price the combined company’s common stock and frustrate attempts by our stockholders to make changes in management. Following the Business Combination, the combined company’s certificate of incorporation and bylaws will provide for an exclusive forum in the Court of Chancery of the State of Delaware for certain disputes between the combined company and its stockholders, and that the federal district courts of the United States will be the exclusive forum for the resolution of any complaint asserting a cause of action under the Securities Act of 1933, as amended, which could discourage claims or limit stockholders’ ability to make a claim against the combined company, its directors, officers, other employees, or stockholders. The combined company will incur significant expenses as a result of being a public company, which could materially adversely affect the combined company’s business, results of operations, and financial condition. Our quarterly operating results may fluctuate significantly or may fall below the expectations of investors or securities analysts, each of which may cause our stock price to fluctuate or decline. After the completion of the Business Combination, we may be at an increased risk of securities class action litigation. Risk Factors 7

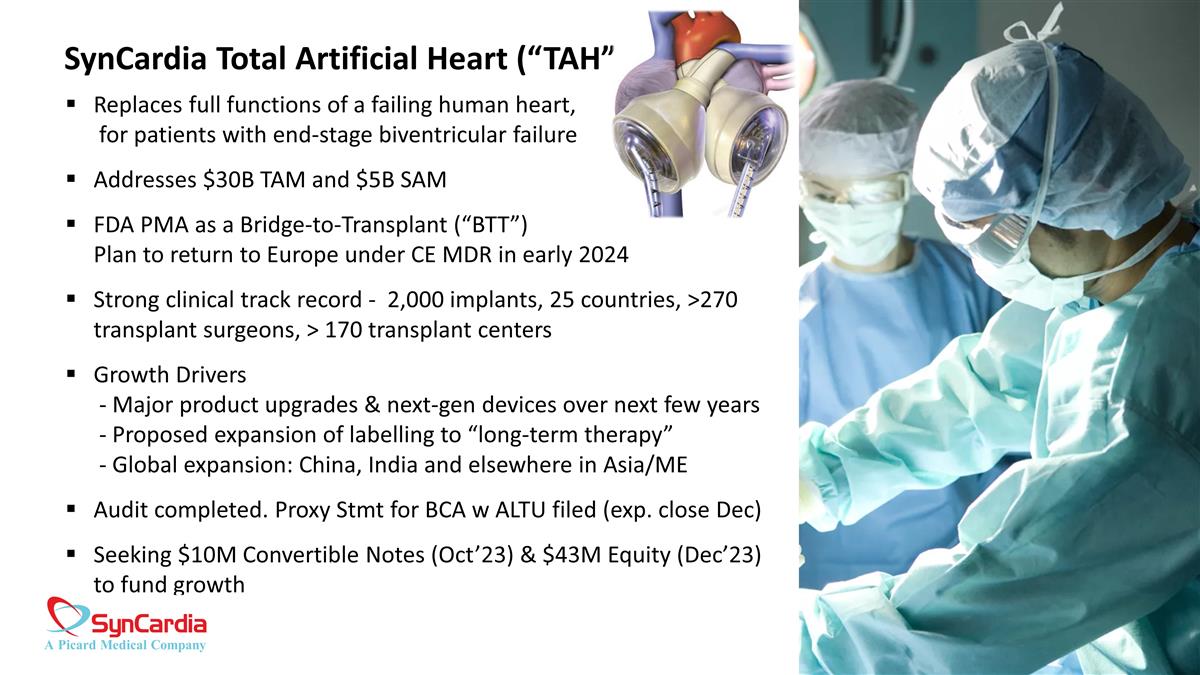

SynCardia Total Artificial Heart (“TAH”) Replaces full functions of a failing human heart, for patients with end-stage biventricular failure Addresses $30B TAM and $5B SAM FDA PMA as a Bridge-to-Transplant (“BTT”) Plan to return to Europe under CE MDR in early 2024 Strong clinical track record - 2,000 implants, 25 countries, >270 transplant surgeons, > 170 transplant centers Growth Drivers - Major product upgrades & next-gen devices over next few years - Proposed expansion of labelling to “long-term therapy” - Global expansion: China, India and elsewhere in Asia/ME Audit completed. Proxy Stmt for BCA w ALTU filed (exp. close Dec) Seeking $10M Convertible Notes (Oct’23) & $43M Equity (Dec’23) to fund growth

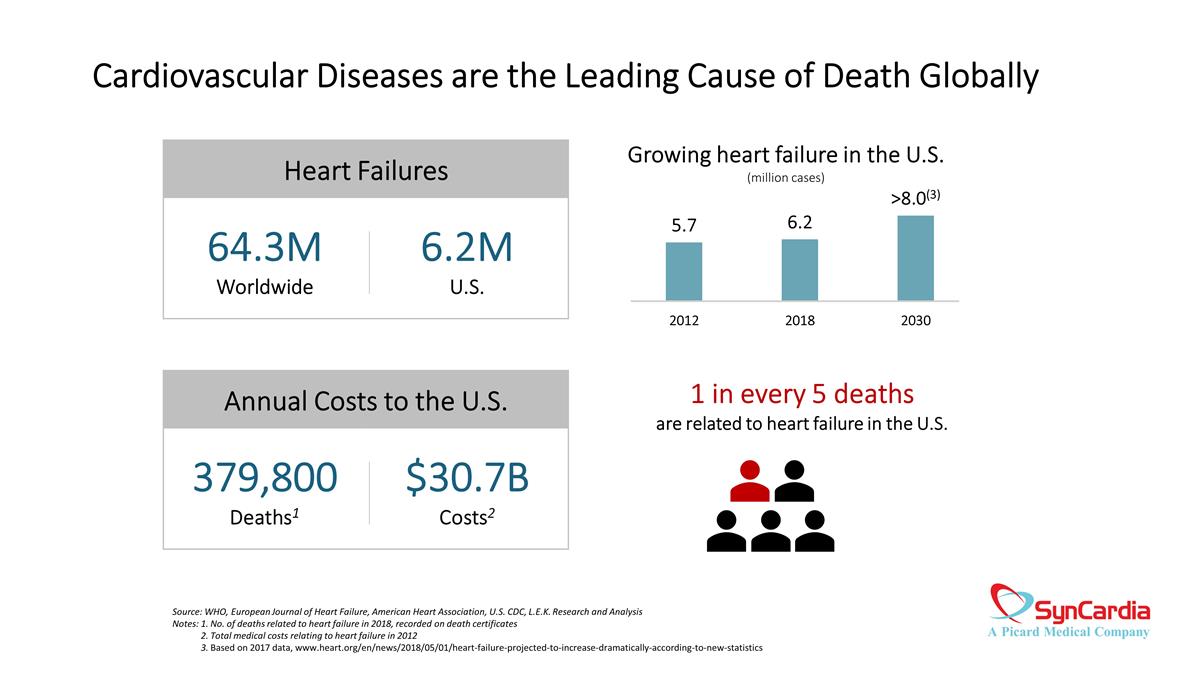

Cardiovascular Diseases are the Leading Cause of Death Globally Source: WHO, European Journal of Heart Failure, American Heart Association, U.S. CDC, L.E.K. Research and Analysis Notes: 1. No. of deaths related to heart failure in 2018, recorded on death certificates 2. Total medical costs relating to heart failure in 2012 3. Based on 2017 data, www.heart.org/en/news/2018/05/01/heart-failure-projected-to-increase-dramatically-according-to-new-statistics Heart Failures 64.3M Worldwide 6.2M U.S. Annual Costs to the U.S. 379,800 Deaths1 $30.7B Costs2 1 in every 5 deaths are related to heart failure in the U.S. Growing heart failure in the U.S. (million cases)

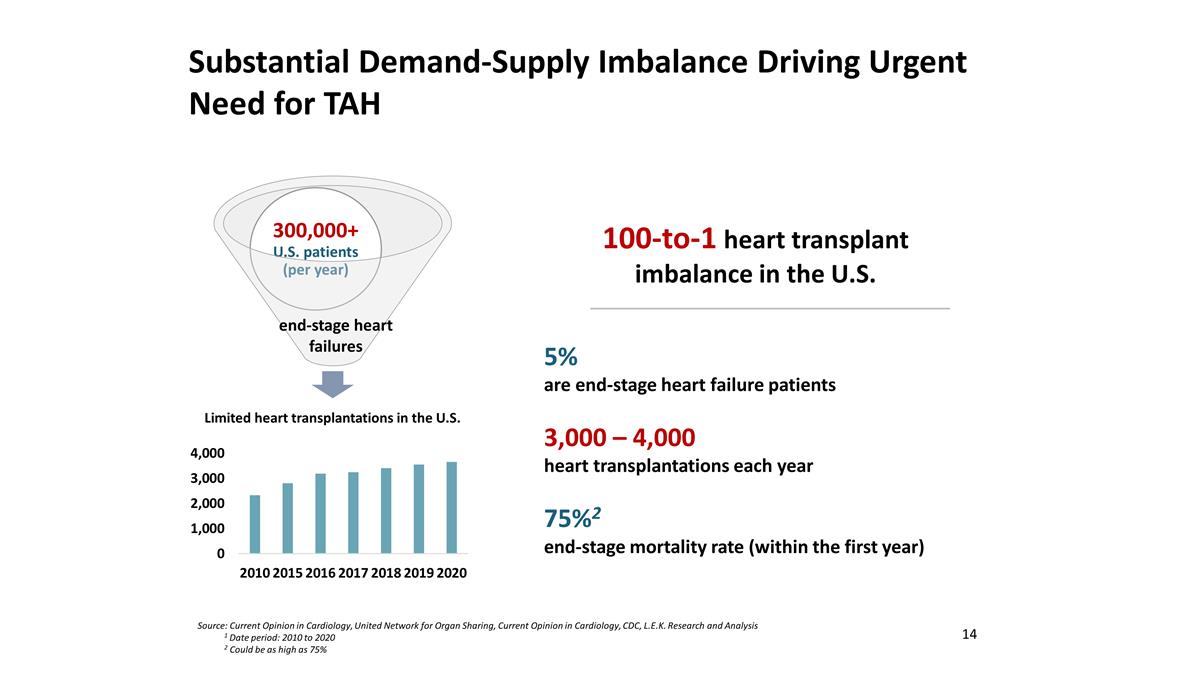

Substantial Demand-Supply Imbalance Driving Urgent Need for TAH Source: Current Opinion in Cardiology, United Network for Organ Sharing, Current Opinion in Cardiology, CDC, L.E.K. Research and Analysis 1 Date period: 2010 to 2020 2 Could be as high as 75% end-stage heart failures 5% are end-stage heart failure patients 3,000 – 4,000 heart transplantations each year 75%2 end-stage mortality rate (within the first year) 100-to-1 heart transplant imbalance in the U.S. 14

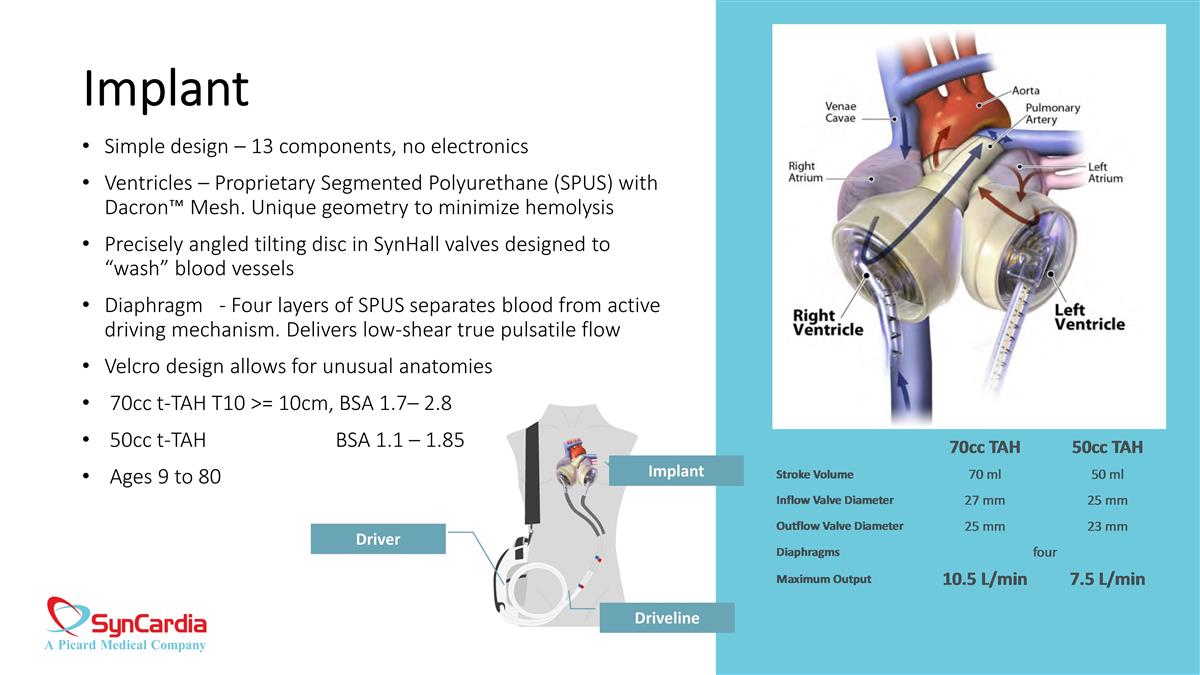

Implant Simple design – 13 components, no electronics Ventricles – Proprietary Segmented Polyurethane (SPUS) with Dacron™ Mesh. Unique geometry to minimize hemolysis Precisely angled tilting disc in SynHall valves designed to “wash” blood vessels Diaphragm - Four layers of SPUS separates blood from active driving mechanism. Delivers low-shear true pulsatile flow Velcro design allows for unusual anatomies 70cc t-TAH T10 >= 10cm, BSA 1.7– 2.8 50cc t-TAH BSA 1.1 – 1.85 Ages 9 to 80 Driver Implant Driveline

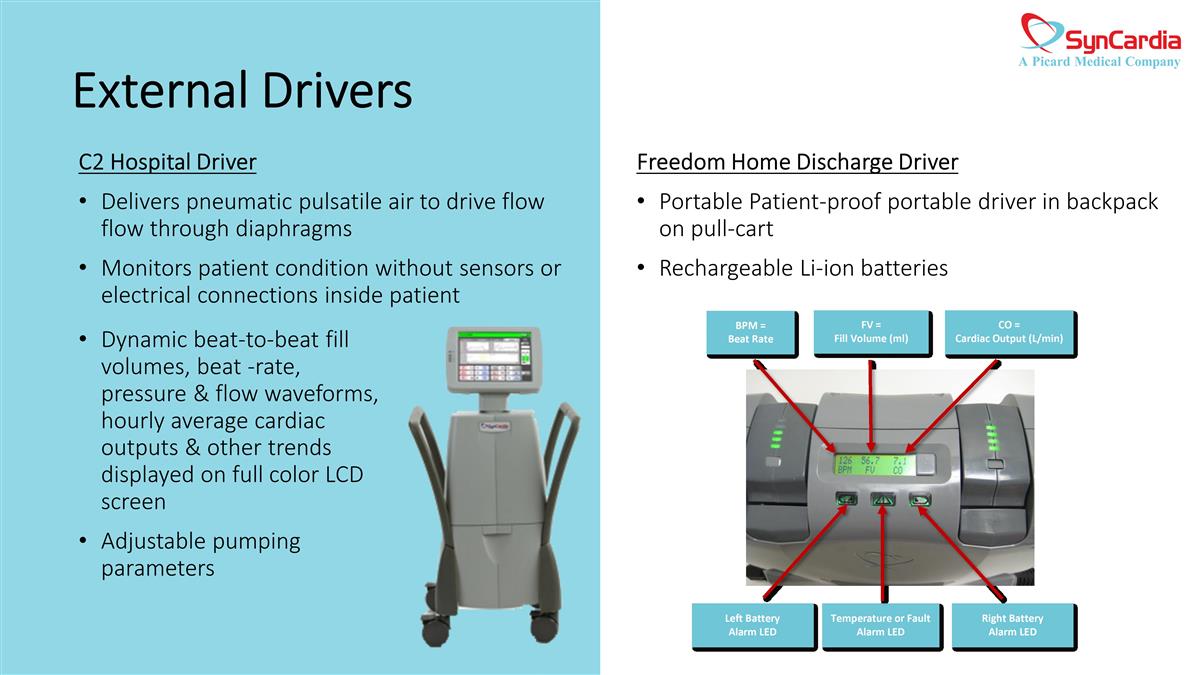

Freedom Home Discharge Driver Portable Patient-proof portable driver in backpack on pull-cart Rechargeable Li-ion batteries C2 Hospital Driver Delivers pneumatic pulsatile air to drive flow flow through diaphragms Monitors patient condition without sensors or electrical connections inside patient Dynamic beat-to-beat fill volumes, beat -rate, pressure & flow waveforms, hourly average cardiac outputs & other trends displayed on full color LCD screen Adjustable pumping parameters External Drivers

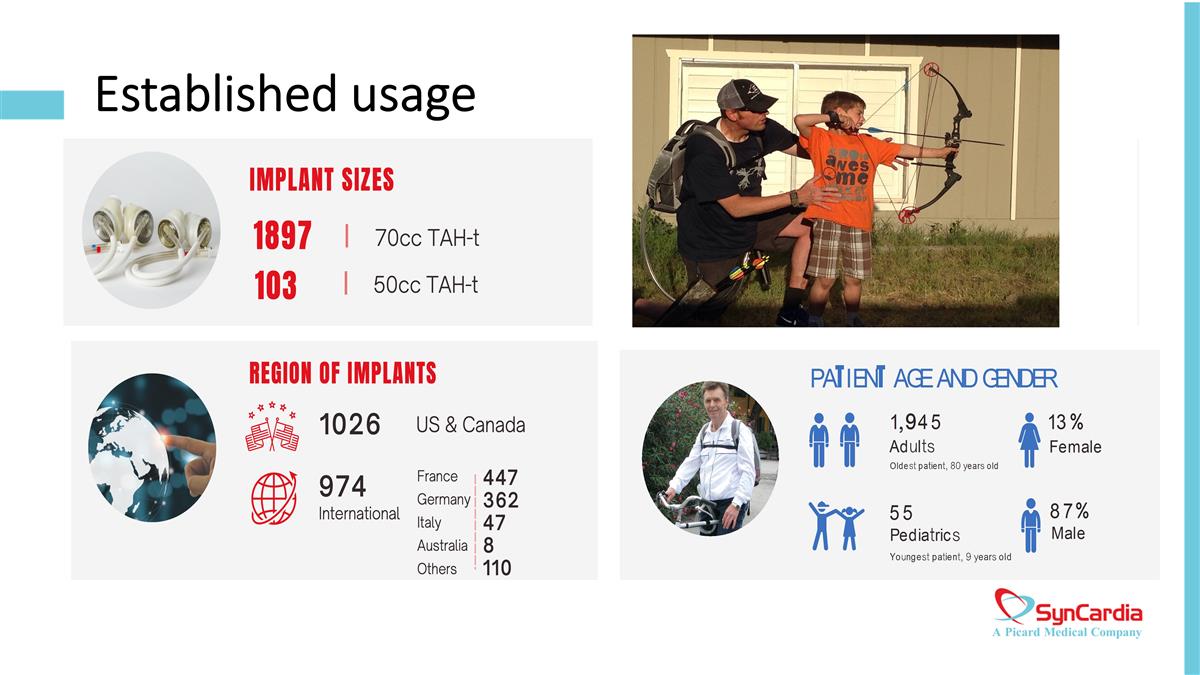

Established usage

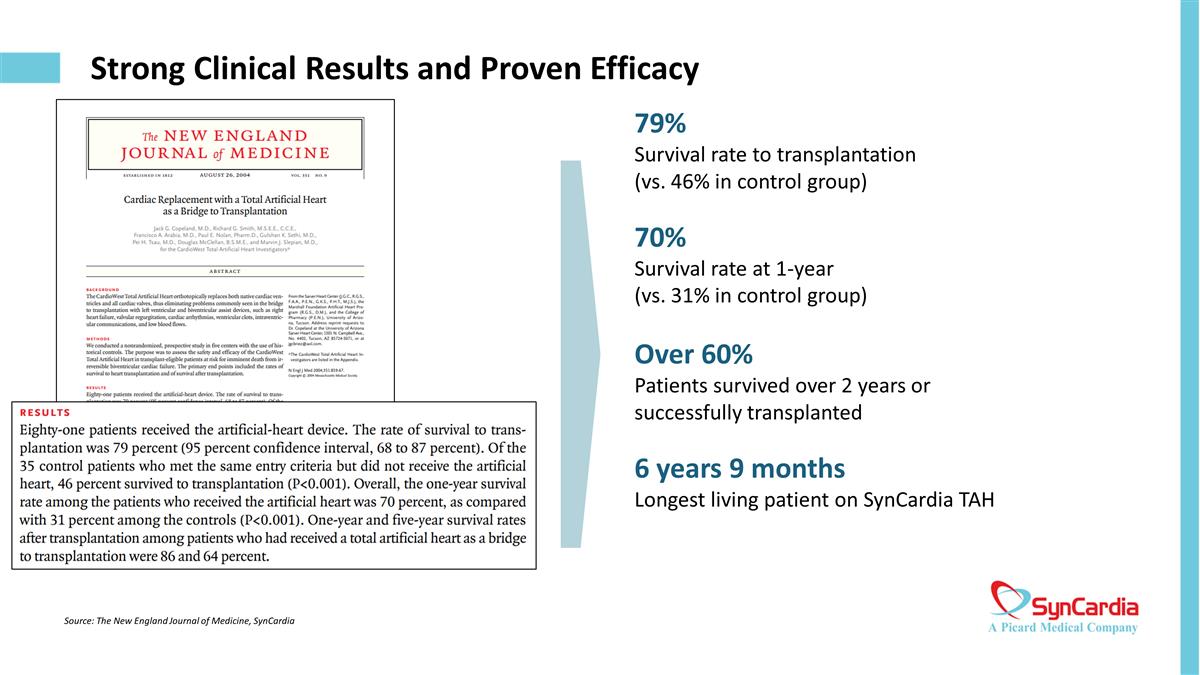

Strong Clinical Results and Proven Efficacy Source: The New England Journal of Medicine, SynCardia 79% Survival rate to transplantation (vs. 46% in control group) 70% Survival rate at 1-year (vs. 31% in control group) Over 60% Patients survived over 2 years or successfully transplanted 6 years 9 months Longest living patient on SynCardia TAH

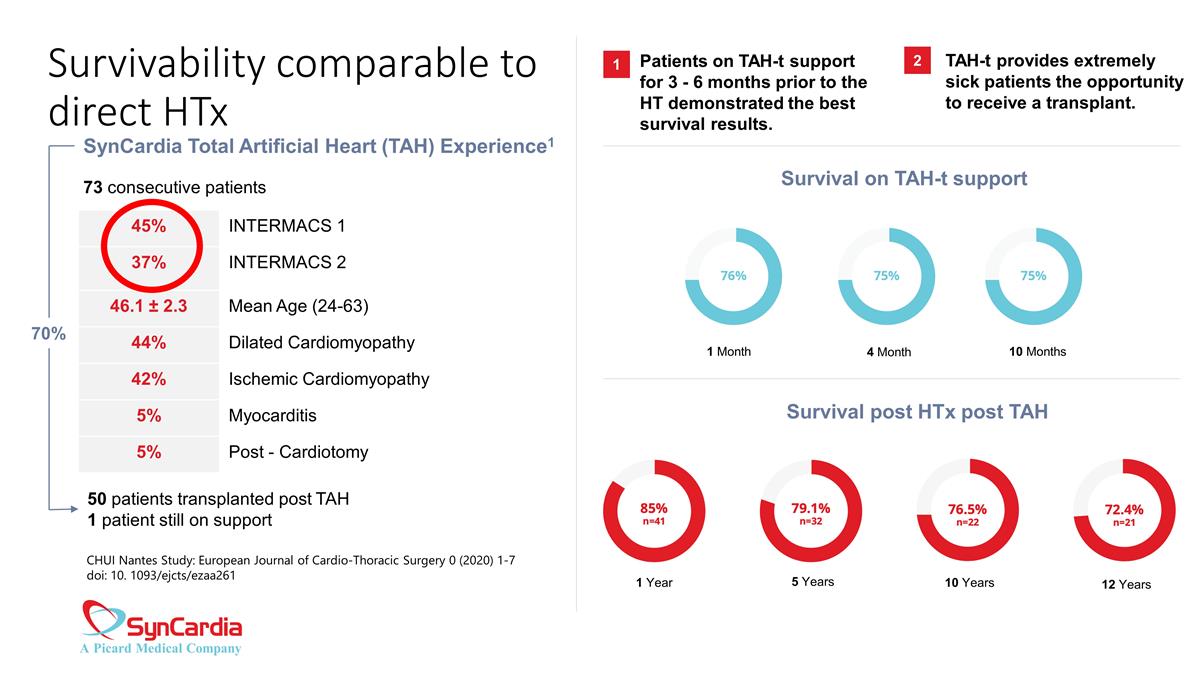

Survivability comparable to direct HTx SynCardia Total Artificial Heart (TAH) Experience1 45% INTERMACS 1 37% INTERMACS 2 46.1 ± 2.3 Mean Age (24-63) 44% Dilated Cardiomyopathy 42% Ischemic Cardiomyopathy 5% Myocarditis 5% Post - Cardiotomy 73 consecutive patients 50 patients transplanted post TAH 1 patient still on support CHUI Nantes Study: European Journal of Cardio-Thoracic Surgery 0 (2020) 1-7 doi: 10. 1093/ejcts/ezaa261 70% Patients on TAH-t support for 3 - 6 months prior to the HT demonstrated the best survival results. TAH-t provides extremely sick patients the opportunity to receive a transplant. 1 2 Survival on TAH-t support Survival post HTx post TAH 1 Month 4 Month 10 Months 1 Year 5 Years 10 Years 12 Years

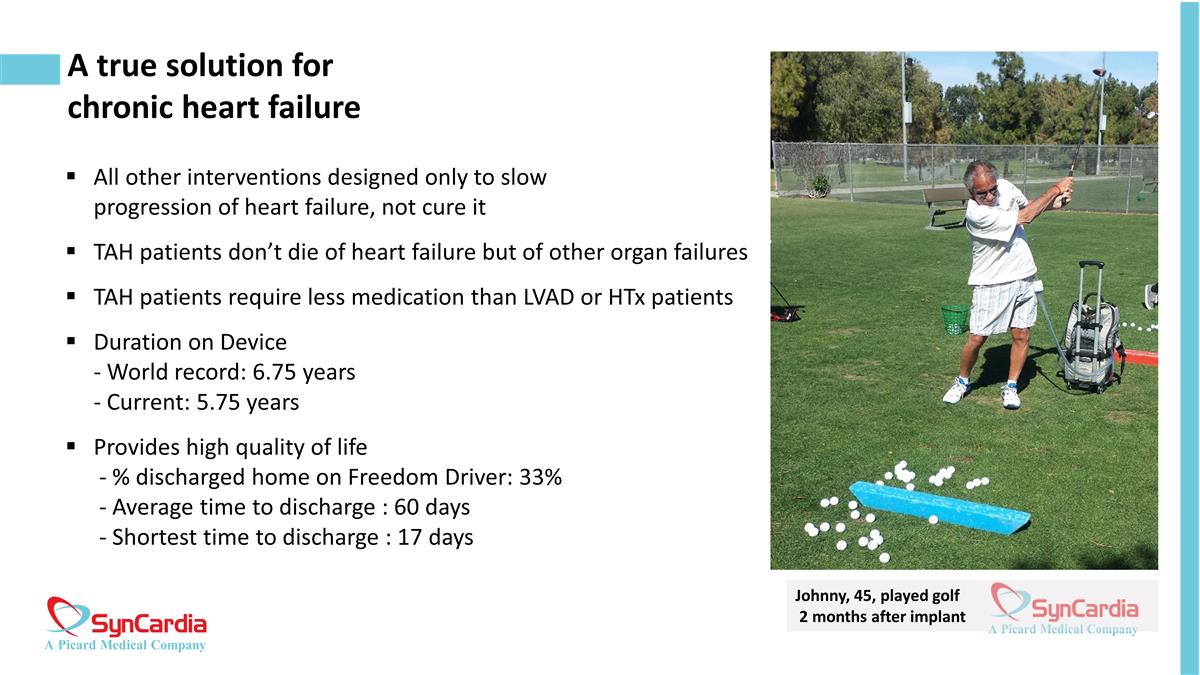

A true solution for chronic heart failure All other interventions designed only to slow progression of heart failure, not cure it TAH patients don’t die of heart failure but of other organ failures TAH patients require less medication than LVAD or HTx patients Duration on Device - World record: 6.75 years - Current: 5.75 years Provides high quality of life - % discharged home on Freedom Driver: 33% - Average time to discharge : 60 days - Shortest time to discharge : 17 days Johnny, 45, played golf 2 months after implant

Amazing patients enjoying a high quality of life Source: SynCardia Mohamad, 27, the first TAH transplant in Lebanon Chris, 51, hiked a total of 607 miles after TAH transplantation Stan, 23, played basketball wearing Freedom® Portable Driver in the backpack Randy, 39, completed the 4.2-mile Pat’s Run event Nurullah, 61, supported by SynCardia TAH for over 1,700 days Bob, 55, went on hunting trips using the SynCardia TAH Andrei, 12, one of the youngest patients from Italy Jahiem, 11, supported by SynCardia TAH for 280 days

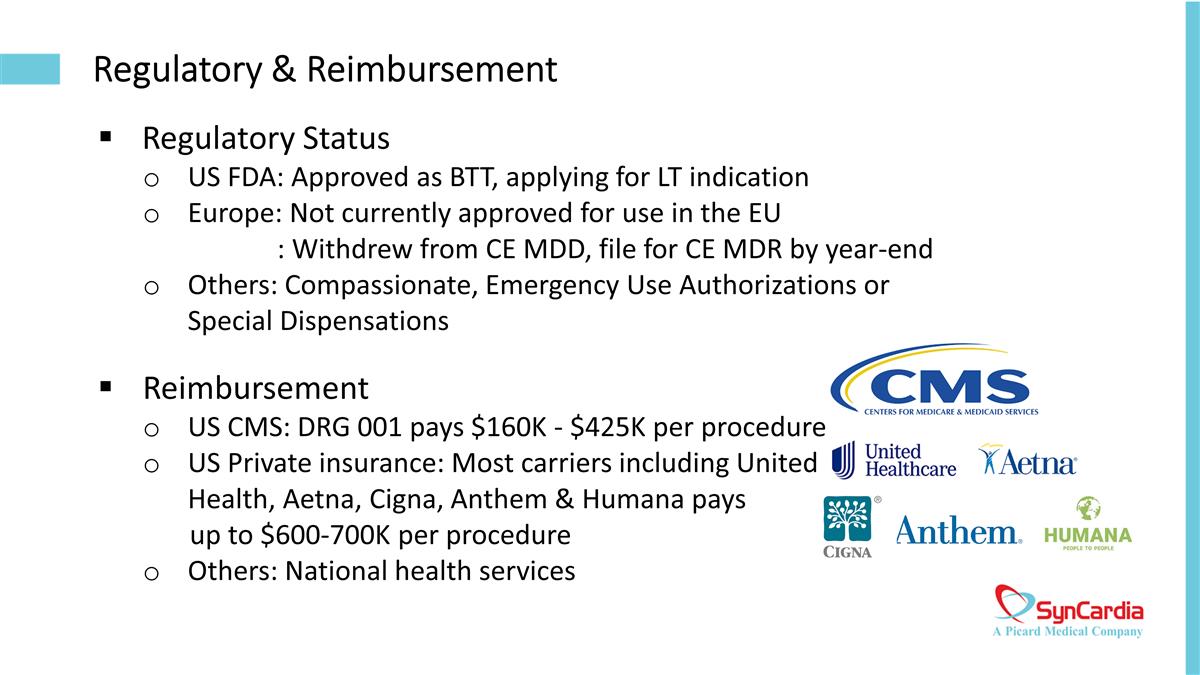

Regulatory & Reimbursement Regulatory Status US FDA: Approved as BTT, applying for LT indication Europe: Not currently approved for use in the EU : Withdrew from CE MDD, file for CE MDR by year-end Others: Compassionate, Emergency Use Authorizations or Special Dispensations Reimbursement US CMS: DRG 001 pays $160K - $425K per procedure US Private insurance: Most carriers including United Health, Aetna, Cigna, Anthem & Humana pays up to $600-700K per procedure Others: National health services

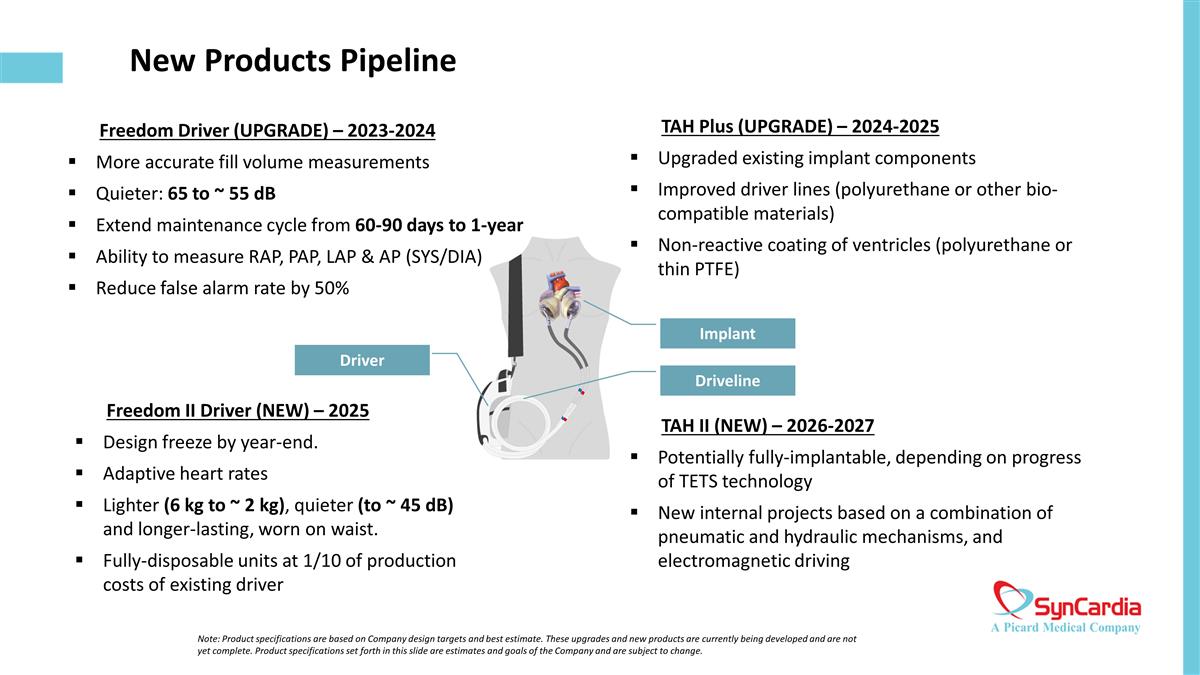

New Products Pipeline Freedom Driver (UPGRADE) – 2023-2024 More accurate fill volume measurements Quieter: 65 to ~ 55 dB Extend maintenance cycle from 60-90 days to 1-year Ability to measure RAP, PAP, LAP & AP (SYS/DIA) Reduce false alarm rate by 50% Freedom II Driver (NEW) – 2025 Design freeze by year-end. Adaptive heart rates Lighter (6 kg to ~ 2 kg), quieter (to ~ 45 dB) and longer-lasting, worn on waist. Fully-disposable units at 1/10 of production costs of existing driver Driver Driveline Implant TAH Plus (UPGRADE) – 2024-2025 Upgraded existing implant components Improved driver lines (polyurethane or other bio-compatible materials) Non-reactive coating of ventricles (polyurethane or thin PTFE) TAH II (NEW) – 2026-2027 Potentially fully-implantable, depending on progress of TETS technology New internal projects based on a combination of pneumatic and hydraulic mechanisms, and electromagnetic driving Note: Product specifications are based on Company design targets and best estimate. These upgrades and new products are currently being developed and are not yet complete. Product specifications set forth in this slide are estimates and goals of the Company and are subject to change.

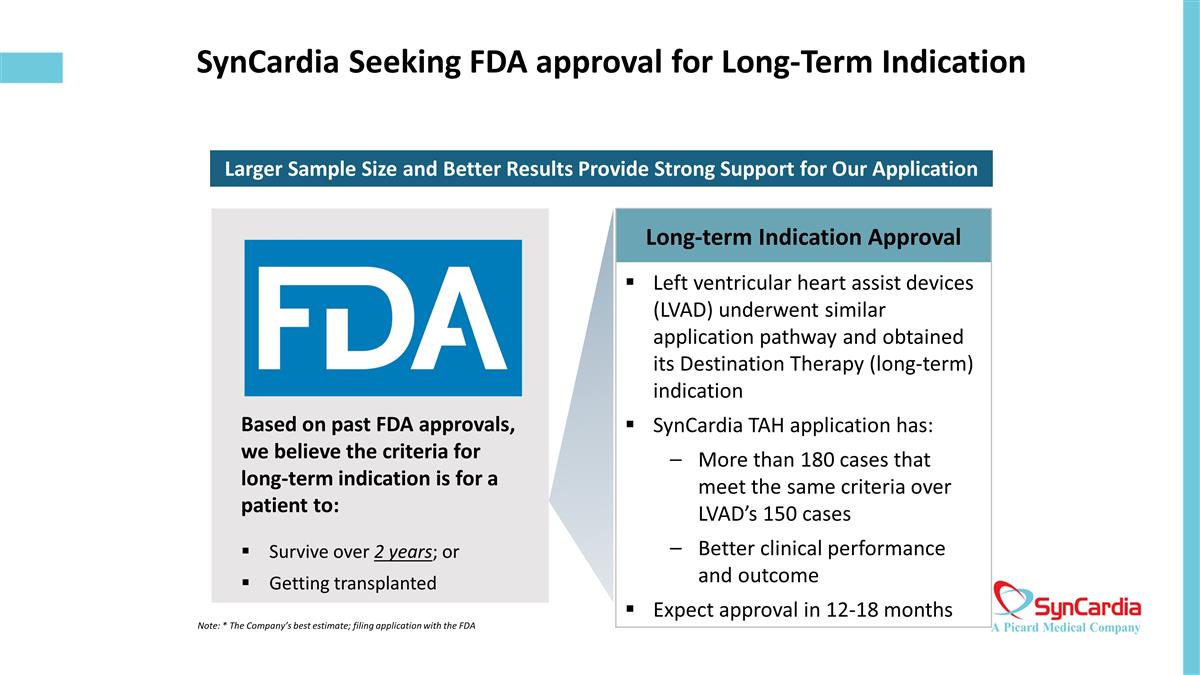

SynCardia Seeking FDA approval for Long-Term Indication Based on past FDA approvals, we believe the criteria for long-term indication is for a patient to: Survive over 2 years; or Getting transplanted Long-term Indication Approval Left ventricular heart assist devices (LVAD) underwent similar application pathway and obtained its Destination Therapy (long-term) indication SynCardia TAH application has: More than 180 cases that meet the same criteria over LVAD’s 150 cases Better clinical performance and outcome Expect approval in 12-18 months Larger Sample Size and Better Results Provide Strong Support for Our Application Note: * The Company’s best estimate; filing application with the FDA

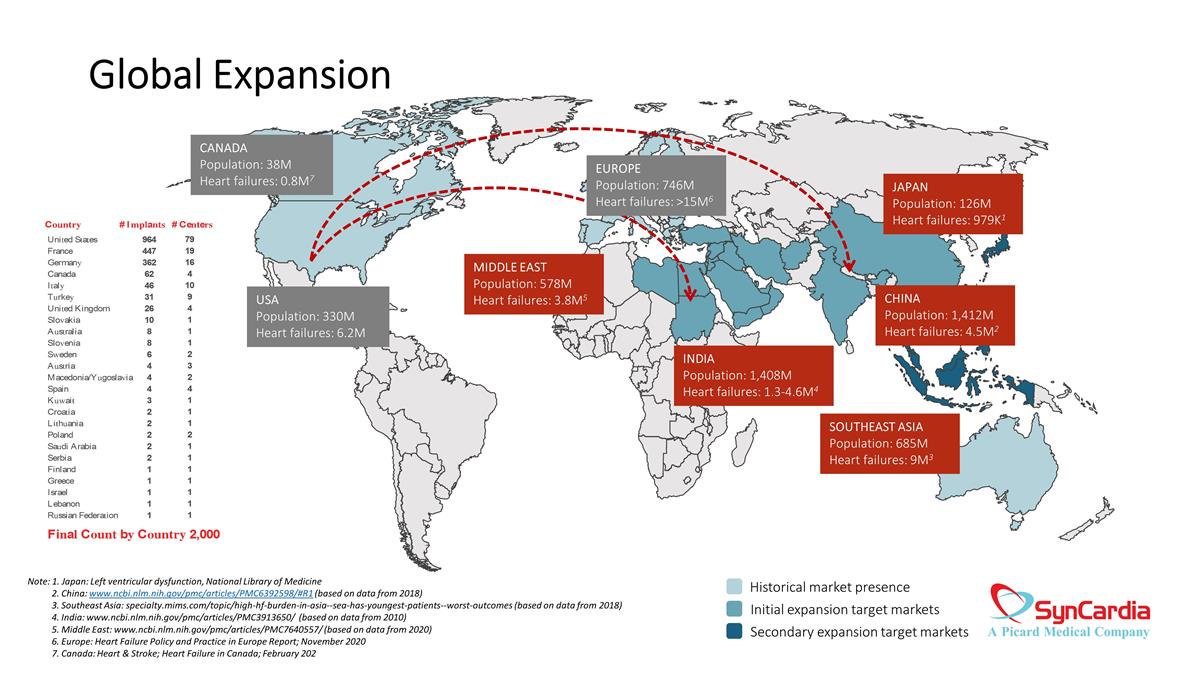

Significant Progress in Global Market Expansion Seeking local partner in India and initiated regulatory registration process in 2022 Completing training programs with several transplant hospitals and preparing for first heart transplant in 2023 CHINA MIDDLE EAST SOUTHEAST ASIA Working towards obtaining a Thai FDA registration for the TAH system Interest received from Philippines to distribute products Finalizing partnership and distribution agreements, expected in 2023 Initial expansion target markets Secondary expansion target markets Established a non-wholly owned subsidiary in Jul 2023 Have hired 12 people specialized in clinical trials and regulatory approval Preparing for submission to China MNPA and expect to obtain approval in 2024 Building localized presence for R&D, marketing & sales teams with limited manufacturing and technical support More than 30 implants already in Turkey, Kuwait, Lebanon & Israel Working with King Faisal Specialist Hospital & Research Center (Saudi Arabia) Seeking more distribution partner(s) in Middle East INDIA

Global Expansion Historical market presence Initial expansion target markets Secondary expansion target markets JAPAN Population: 126M Heart failures: 979K1 CHINA Population: 1,412M Heart failures: 4.5M2 SOUTHEAST ASIA Population: 685M Heart failures: 9M3 MIDDLE EAST Population: 578M Heart failures: 3.8M5 INDIA Population: 1,408M Heart failures: 1.3-4.6M4 EUROPE Population: 746M Heart failures: >15M6 CANADA Population: 38M Heart failures: 0.8M7 USA Population: 330M Heart failures: 6.2M Note: 1. Japan: Left ventricular dysfunction, National Library of Medicine 2. China: www.ncbi.nlm.nih.gov/pmc/articles/PMC6392598/#R1 (based on data from 2018) 3. Southeast Asia: specialty.mims.com/topic/high-hf-burden-in-asia--sea-has-youngest-patients--worst-outcomes (based on data from 2018) 4. India: www.ncbi.nlm.nih.gov/pmc/articles/PMC3913650/ (based on data from 2010) 5. Middle East: www.ncbi.nlm.nih.gov/pmc/articles/PMC7640557/ (based on data from 2020) 6. Europe: Heart Failure Policy and Practice in Europe Report; November 2020 7. Canada: Heart & Stroke; Heart Failure in Canada; February 202

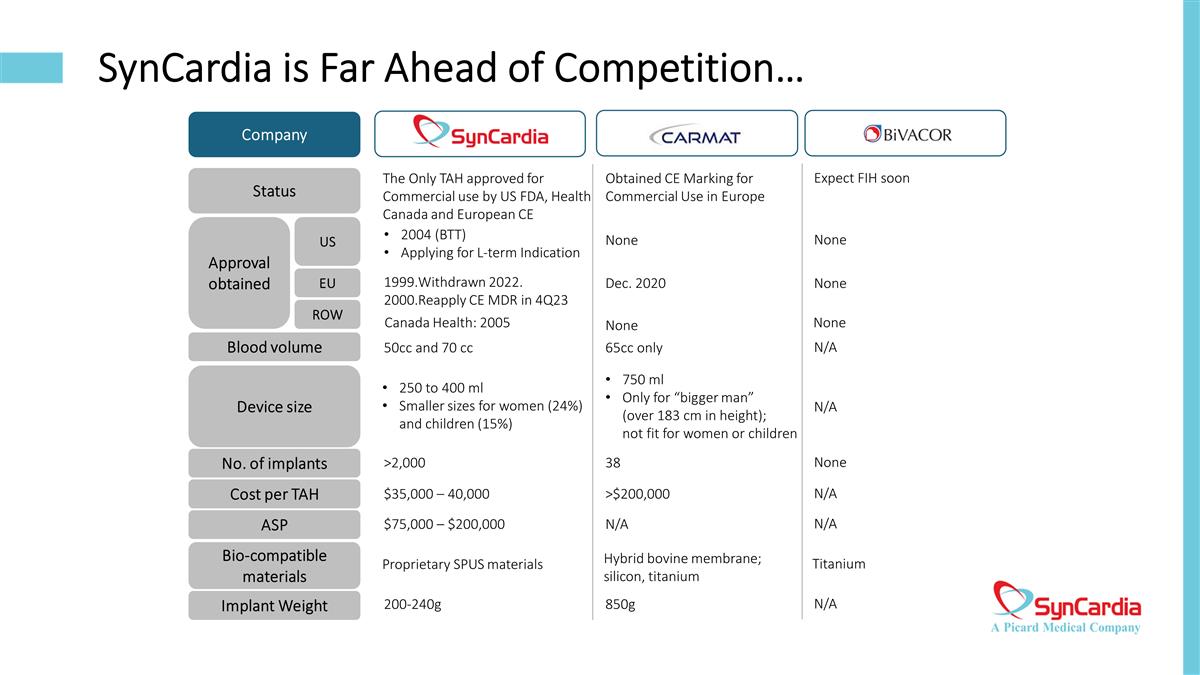

SynCardia is Far Ahead of Competition… Company Status Approval obtained US EU ROW Blood volume Device size No. of implants Cost per TAH ASP Bio-compatible materials Implant Weight The Only TAH approved for Commercial use by US FDA, Health Canada and European CE Obtained CE Marking for Commercial Use in Europe Expect FIH soon 2004 (BTT) Applying for L-term Indication None None Withdrawn 2022. Reapply CE MDR in 4Q23 Dec. 2020 None Canada Health: 2005 None None 50cc and 70 cc 65cc only N/A 250 to 400 ml Smaller sizes for women (24%) and children (15%) 750 ml Only for “bigger man” (over 183 cm in height); not fit for women or children N/A >2,000 38 None $35,000 – 40,000 >$200,000 N/A $75,000 – $200,000 N/A N/A Proprietary SPUS materials Hybrid bovine membrane; silicon, titanium Titanium 200-240g 850g N/A

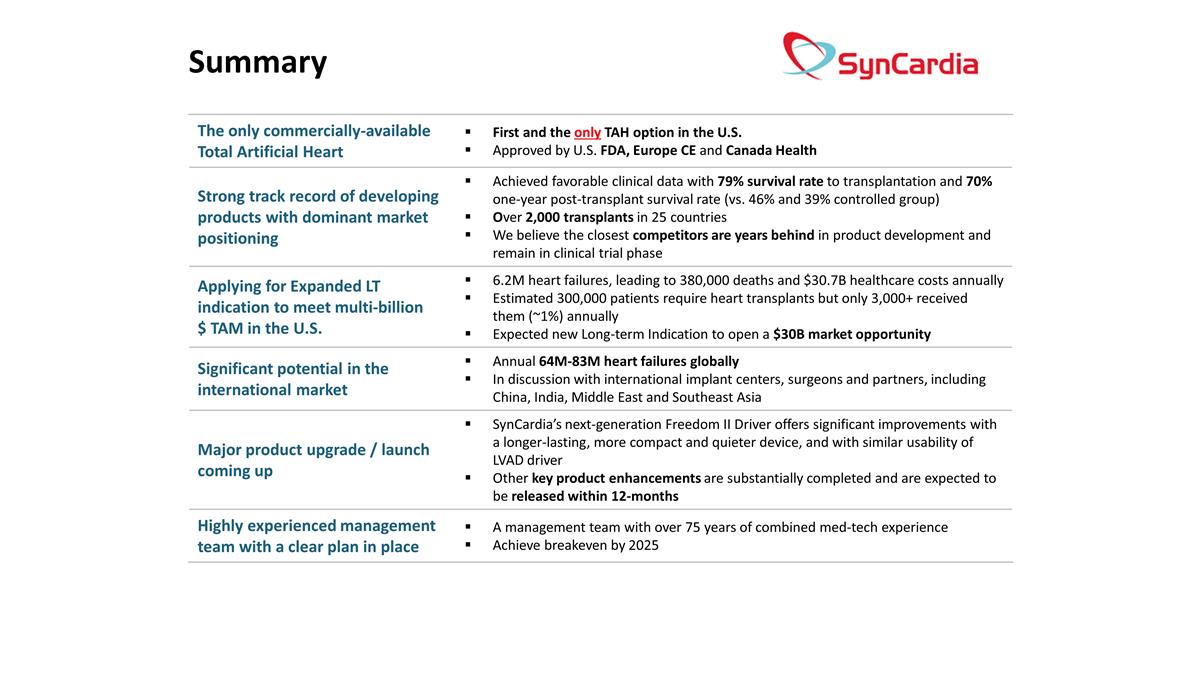

Summary The only commercially-available Total Artificial Heart First and the only TAH option in the U.S. Approved by U.S. FDA, Europe CE and Canada Health Strong track record of developing products with dominant market positioning Achieved favorable clinical data with 79% survival rate to transplantation and 70% one-year post-transplant survival rate (vs. 46% and 39% controlled group) Over 2,000 transplants in 25 countries We believe the closest competitors are years behind in product development and remain in clinical trial phase Applying for Expanded LT indication to meet multi-billion $ TAM in the U.S. 6.2M heart failures, leading to 380,000 deaths and $30.7B healthcare costs annually Estimated 300,000 patients require heart transplants but only 3,000+ received them (~1%) annually Expected new Long-term Indication to open a $30B market opportunity Significant potential in the international market Annual 64M-83M heart failures globally In discussion with international implant centers, surgeons and partners, including China, India, Middle East and Southeast Asia Major product upgrade / launch coming up SynCardia’s next-generation Freedom II Driver offers significant improvements with a longer-lasting, more compact and quieter device, and with similar usability of LVAD driver Other key product enhancements are substantially completed and are expected to be released within 12-months Highly experienced management team with a clear plan in place A management team with over 75 years of combined med-tech experience Achieve breakeven by 2025